More from News 12

2:16

Officials, community discuss impact of act that will seal certain criminal records

2:33

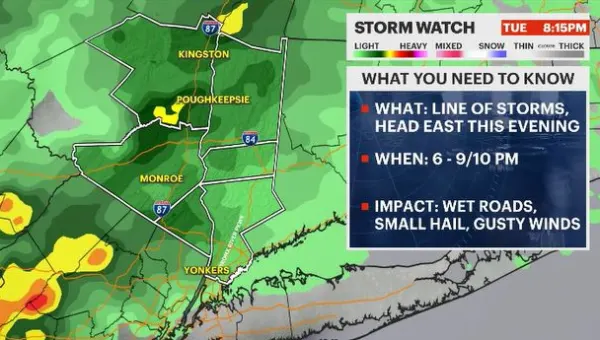

STORM WATCH: Thunderstorms, showers overnight in the Hudson Valley

2:07

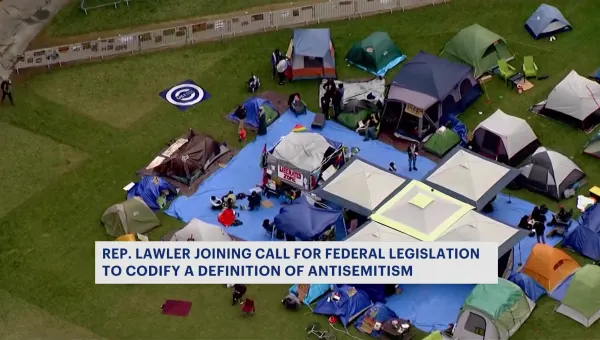

Vassar student encampment grows as college leaders respond to students' demands regarding Israel-Hamas war

0:34

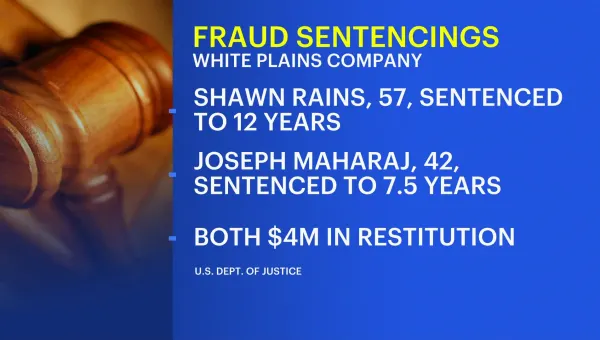

Executives who defrauded White Plains-based OrthoNet sentenced, must pay back millions

1:45

Community members express ‘bleak’ outlook for City of Newburgh Police Department following chief’s resignation

1:45

Harrison holds public hearing on proposed solar project

1:53

Shop Mother’s Day Gifts – Exclusive Offers Up to 75% OFF!

1:08

Rep. Lawler leads push to codify more strict definition of antisemitism

0:31

Fallsburg police search for missing 14-year-old girl

1:45

4th annual Diverse Ability Job Fair draws hundreds seeking opportunities

0:43

Congressmen call for Metro-North discounts extension to Hudson Valley riders

0:19

Bronx man charged with criminally negligent homicide in death of Sullivan County man

0:34

2 Ulster County brothers convicted of murdering father of 2

0:19

Middletown man sentenced to 10 years in prison for child rape

0:45

Dobbs Ferry condemns racist incidents; urges public vigilance

0:52

Town of Forestburgh rejects AG James claims of unfair zoning restrictions

0:48

North Castle police warn residents following weekend car thefts

0:26

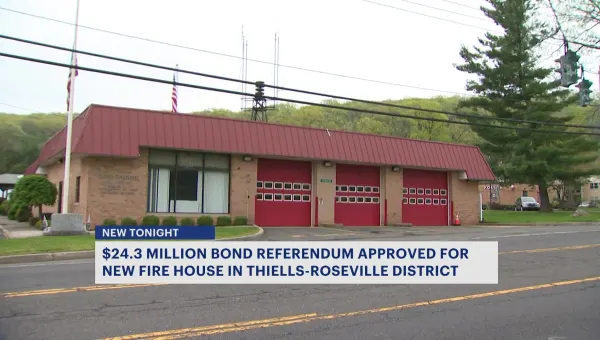

$24.3 million bond referendum passes, vote makes way for new Thiells fire station

0:29