More from News 12

1:23

Pro-Palestinian demonstrators rally in Irvington during President Biden's visits to Westchester

2:41

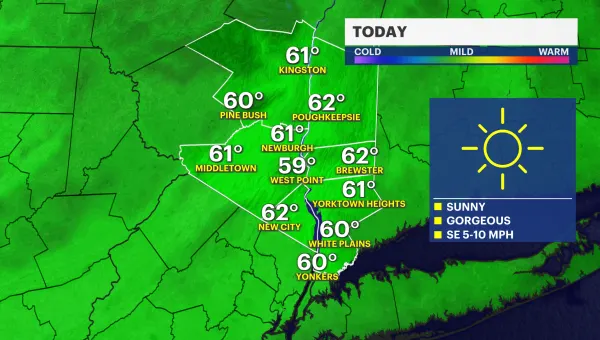

Chilly temps in the Hudson Valley will warm up as afternoon sunshine rolls in

0:26

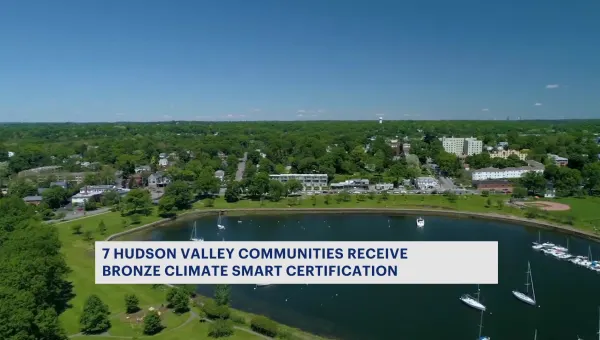

Hudson Valley communities receive bronze Climate Smart Certification

0:21

Greenwood Lake Board of Trustees appoints interim mayor

0:23

Police: 18-year-old facing charges in Walden shooting

0:48

President Biden announces future opening of upstate microchip factory

1:53

Shop Mother’s Day Gifts – Exclusive Offers Up to 75% OFF!

0:21

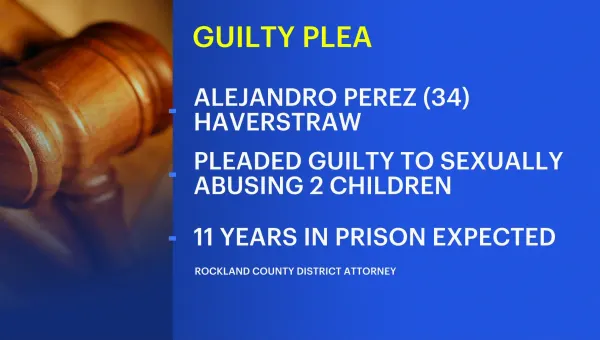

Rockland County DA: Haverstraw man pleads guilty in sexual abuse of 2 children

0:51

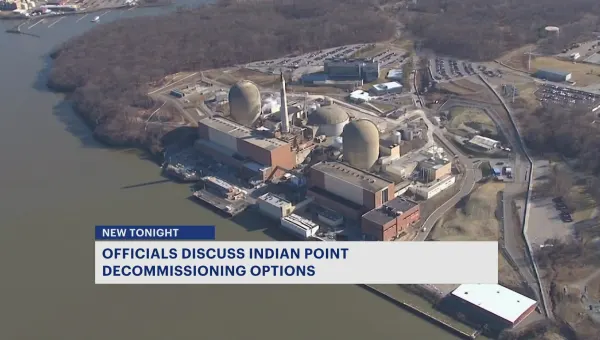

Indian Point oversight board, Holtec discuss decommissioning options of former nuclear plant

0:47

State police: DNA sample from human remains found does not match profile of missing Putnam teen

0:31

New mural of Yonkers hip-hop legend Mary J. Blige unveiled at Palisade Towers

0:35

Police find evidence in burglary while investigating a domestic dispute in Monroe

0:30

Wake services held for the Westchester correction officer who died in Bronx River Parkway crash

Motorists encounter traffic delays, road closures in and around Irvington during President Joe Biden's visit

1:42

Newburgh senior housing manager asks city for help protecting residents

0:25

Dramatic video captures car fire in Nanuet

Vote 2024: Ask your questions for Congressional District 16 Democratic candidates

0:24

New York appeals court overturns Harvey Weinstein’s 2020 rape conviction from landmark #MeToo trial

0:24

Breeze Airways expands services from Westchester County Airport

1:47