NY lawmakers urge families to take advantage of child tax credit

Those who filed their tax returns for 2019-220 or signed up to receive COVID-19 stimulus checks will automatically receive the tax benefit.

News 12 Staff

•

Jul 16, 2021, 5:24 PM

•

Updated 1,022 days ago

Share:

More Stories

0:46

Ex-NYPD officer from Orange County to pay $30M after admitting to sexually abusing 2 of his nieces

4h ago0:28

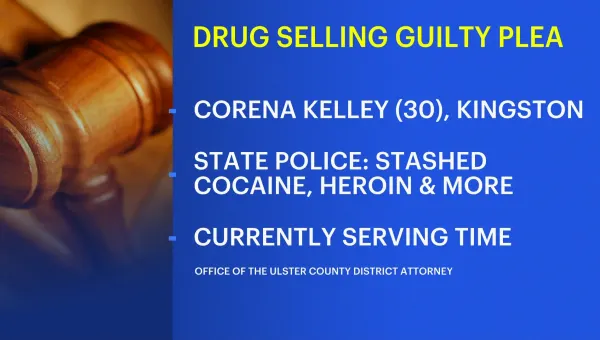

Ulster County DA: Kingston woman pleads guilty for drug possession

4h ago0:23

Police: 14-year-old struck by vehicle in Yonkers

4h ago1:56

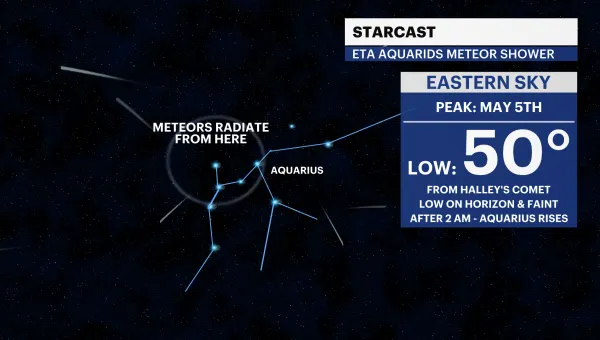

Afternoon showers for Saturday in the Hudson Valley; batches of light rain for Sunday

4h ago0:38

Sam Ash Music announces closure of all store locations

5h ago1:56

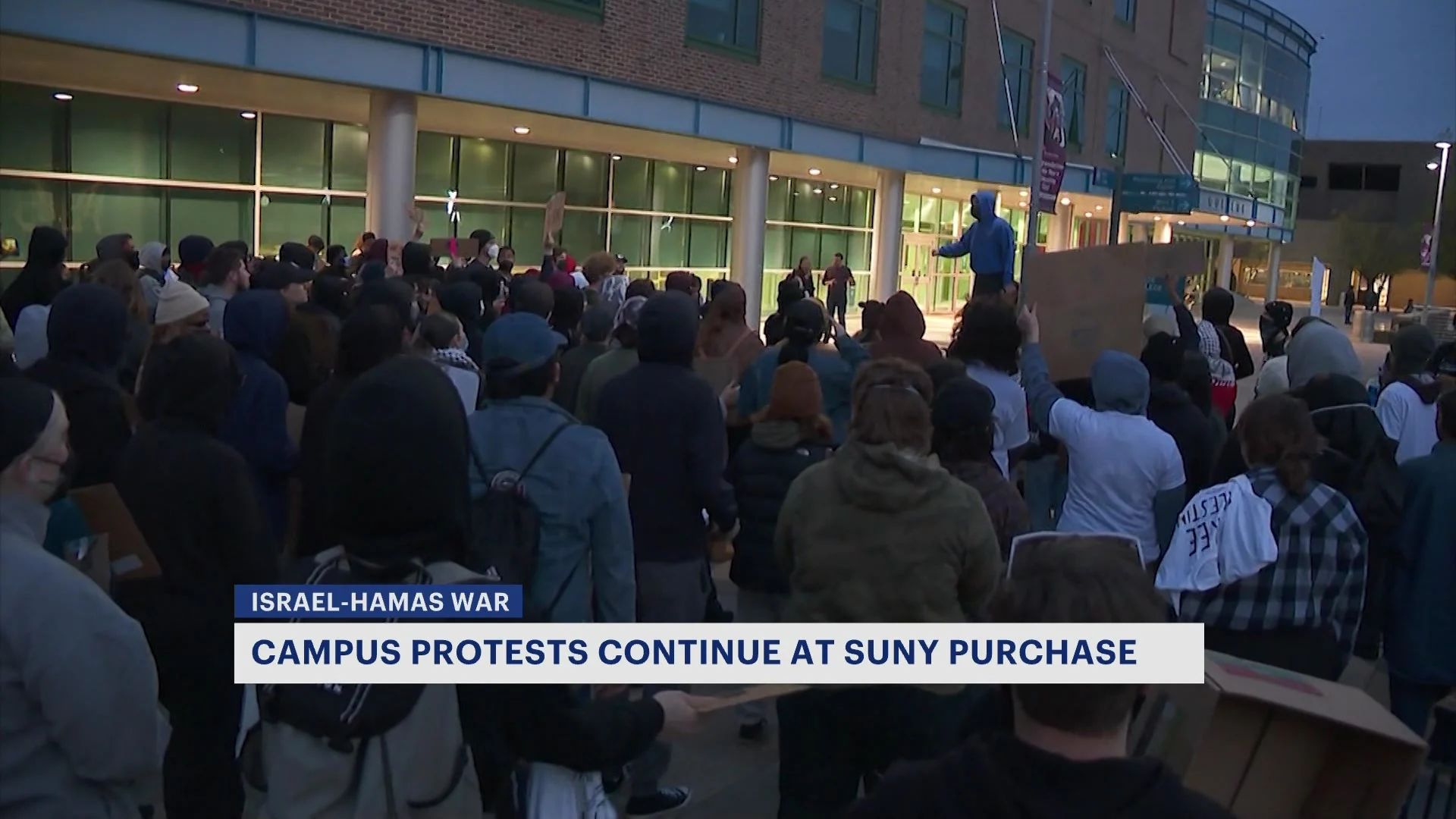

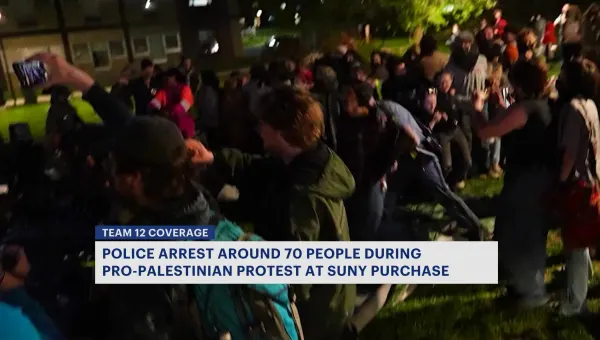

SUNY Purchase administrators monitor campus following encampment arrests

5h ago0:46

Ex-NYPD officer from Orange County to pay $30M after admitting to sexually abusing 2 of his nieces

4h ago0:28

Ulster County DA: Kingston woman pleads guilty for drug possession

4h ago0:23

Police: 14-year-old struck by vehicle in Yonkers

4h ago1:56

Afternoon showers for Saturday in the Hudson Valley; batches of light rain for Sunday

4h ago0:38

Sam Ash Music announces closure of all store locations

5h ago1:56

SUNY Purchase administrators monitor campus following encampment arrests

5h agoLegislators are urging families across the Hudson

Valley to take all the necessary steps to secure the child tax credit.

Sen. Kristen Gillibrand and Rep. Mondaire Jones outlined the

details of the expansion in White Plains Friday.

Monthly payments of up to $250 are rolling out to

bank accounts of families for each child aged 6 to 17 years old.

Those with children under 6 receive $300 every month.

A total of 39 million families across the country are expected

to receive benefits, including families of more than 35 million children under

18 in the state.

“We want to make sure that families get access to

these resources that they are entitled to,” Gillibrand says. “This money is for

them. It’s for their children. It will allow us to lift half of the children

out of poverty who in poverty today.”

Those who filed their tax returns for 2019-220 or

signed up to receive COVID-19 stimulus checks

will automatically receive the tax benefit.

Families that did not earn enough money to file

income taxes in previous years or who welcomed

a new baby into their family in 2021 must sign up on the IRS portal.