More from News 12

0:28

President Biden's visit prompts early dismissals in Westchester schools

2:14

Pop-up showers with breaks of sun today, mostly sunny for the rest of the workweek

Vote 2024: Ask your questions for Congressional District 16 Democratic candidates

1:53

Shop Mother’s Day Gifts – Exclusive Offers Up to 75% OFF!

2:22

Proposal for Putnam County lithium-ion battery storage station raises concerns in Westchester

0:41

Fire destroys car, damages garage in Rhinebeck

0:32

Repeat offender arrested on trespassing charge in Ulster County

News 12 Westchester/Hudson Valley Daily Poll

0:28

Police officer's conduct under review following shoplifting incident at Newburgh Walmart

0:28

Dutchess County bus driver honored as Bus Driver of the Year

1:23

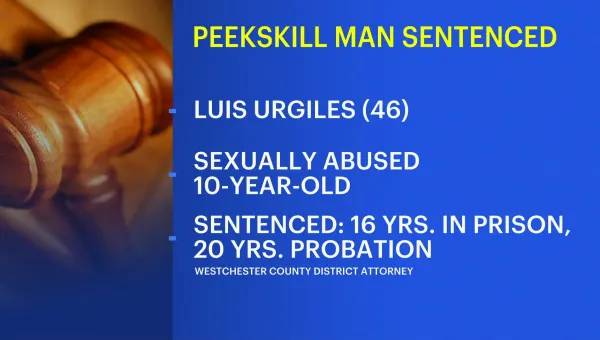

Headlines: Child sex crimes, 70-year-old scammed out of $28,000, crackdown on scooters and motorcycles

0:18

President Biden to deliver commencement address at West Point

0:21

Traffic Alert: Bridge replacement in Dutchess County to begin May 1

0:24

Spring Valley man convicted for violating order of protection and resisting arrest

0:23

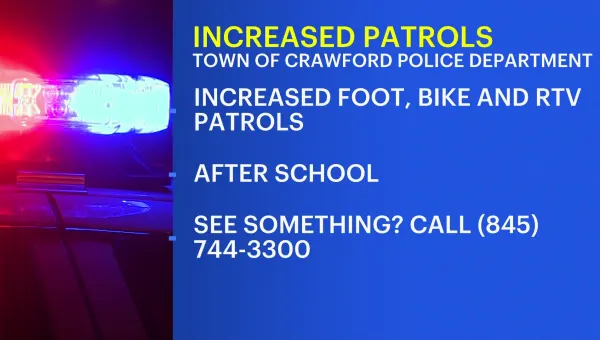

'Inappropriate' behavior by students causes increase in Crawford police patrols

0:49

Yonkers charter school launches automotive career exploration program

0:32

US banning TikTok? Your key questions answered

1:02

Composting can save money, help gardens and save the planet. Here are 10 tips to get you started

2:01

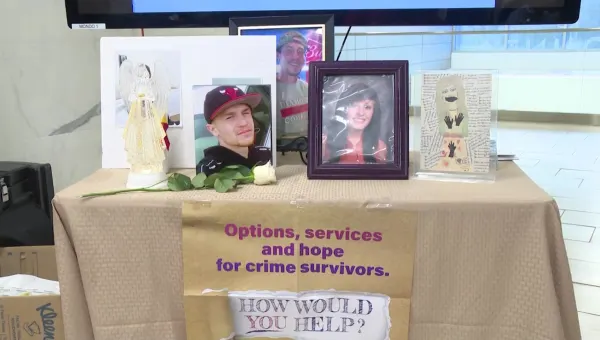

Orange County hosts crime victims' vigil

0:37