Power & Politics: Audit of New York's renewable energy goals and the US Senate targets bank fraud

The May 5 Power & Politics show covered two topics: New York's push for renewable energy and the U.S. Senate efforts to curb major bank fraud.

Share:

More Stories

54:48

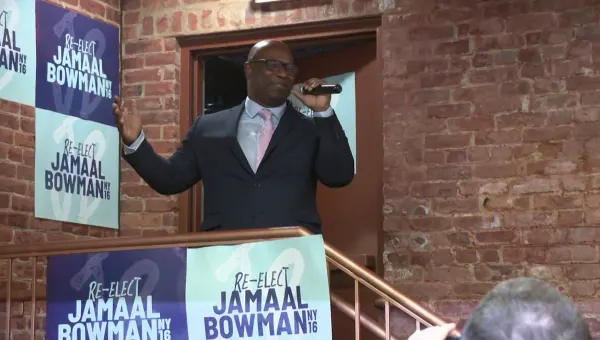

WATCH: Rep. Bowman and Westchester County Executive Latimer debate in race for 16th Congressional District

4ds ago10:49

Power & Politics: Future of the Iroquois Pipeline; NY-16 debate preview

6ds ago21:11

Power & Politics: The race for town supervisor in Yorktown

34ds ago21:11

Power & Politics: Behind-the-scenes tour of Lionsgate Studios

39ds ago21:11

Power & Politics: State lawmakers on school busing; Dutchess State of the County

48ds ago0:59

Power and Politics preview: Lawmakers contemplate TikTok's future

56ds ago54:48

WATCH: Rep. Bowman and Westchester County Executive Latimer debate in race for 16th Congressional District

4ds ago10:49

Power & Politics: Future of the Iroquois Pipeline; NY-16 debate preview

6ds ago21:11

Power & Politics: The race for town supervisor in Yorktown

34ds ago21:11

Power & Politics: Behind-the-scenes tour of Lionsgate Studios

39ds ago21:11

Power & Politics: State lawmakers on school busing; Dutchess State of the County

48ds ago0:59

Power and Politics preview: Lawmakers contemplate TikTok's future

56ds agoThe May 5 Power & Politics show covered two topics: New York's push for renewable energy and the U.S. Senate efforts to curb major bank fraud.

RENEWABLE ENERGY AUDIT

According to a newly released audit from New York State Comptroller Tom DiNapoli, renewable energy projects in New York are taking more than three years just to receive the proper permits to get the work started. The report cited application delays due to missing documentation.

This is important because back in 2019 the state established two benchmarks for its renewable energy production. BY 2030, New York wants to use 70% renewable energy with the goal in 2040 of being fully zero-emission.

These delays could mean the state misses the deadline to meet these goals though the report did not go as far as to conclude that just yet.

DiNapoli called for greater transparency on the process and how long it takes to get these projects in motion so applicants can build that time into the process.

New York State Deputy Comptroller Tina Kim said this report was a way to proactively make sure the state hits those benchmarks.

"You can wait until 2030 and then do report and say we either met the goals or we didn't meet the goals but what the comptroller wants to ensure is that we have appropriate planning and transparency," she said.

ORES officials said they track and meet all time frames required by law during the site permitting process.

SENATE GOES AFTER BANK FRAUD

Last month, members of the U.S. Senate Committee on Banking, Housing, and Urban Affairs sent a letter to the country's four largest banks urging for additional safeguards for businesses and consumers from wire fraud. In that letter to the CEOs of JP Morgan Chase, Bank of America, Wells Fargo and Citi, the senators called for data on wire fraud and their current policies to protect clients.

Last year, consumers lost more than $10 billion to fraud which was up 14% from the year before.

Orange Bank & Trust Senior Vice President Anthony Pili told News 12 any potential legislative changes that come out of this investigation could lead to sweeping reforms for the banking industry.